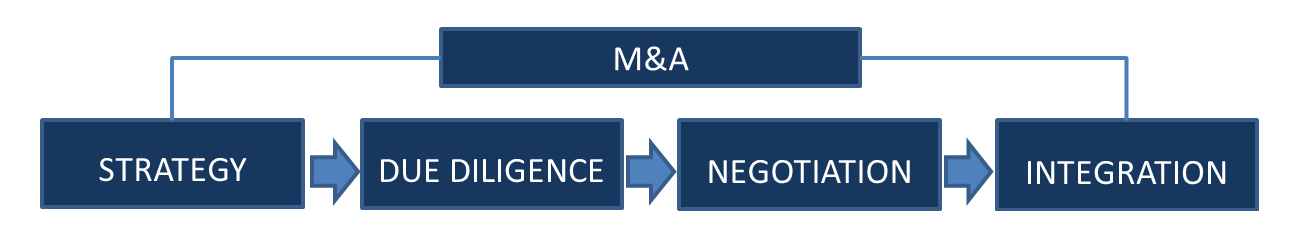

Mariani & Associati Corporate Finance provides assistance and support to its clients in the origination phase as well as in the execution phase of domestic and international M & A transactions.

Mariani & Associati Corporate Finance makes use of the expertise of its Debt Advisory division to evaluate all possible ways to finance the deal.

The purchase or sale of a company is an event which, in many cases, has a significant impact in the life of entrepreneurs.

For this reason the choice to undertake a strategic M & A path should be well considered and above all, well prepared, even with the support of professionals capable, through their experience, to identify the most appropriate solutions based on individual goals.

Our approach is simple but effective:

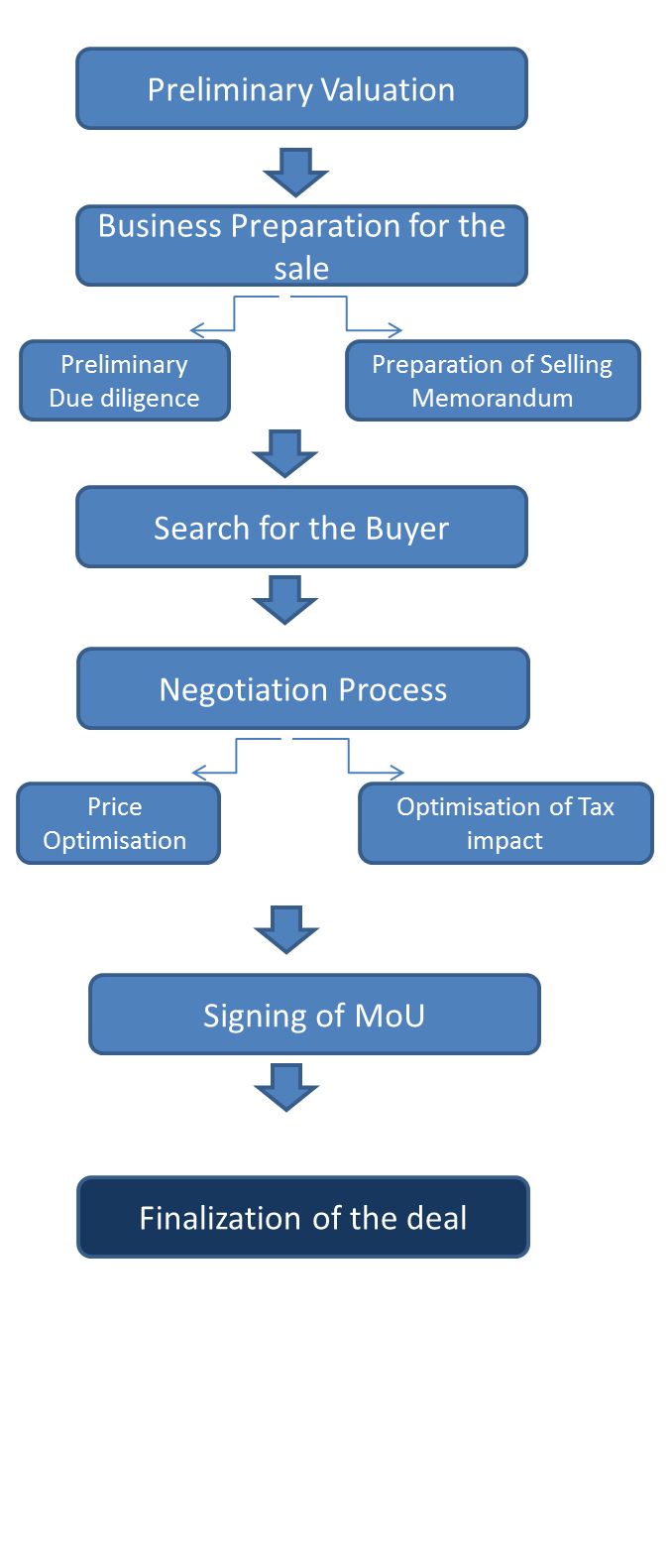

SELL A BUSINESS

The sale process stems from shareholders’ decision to realize capital from their business.

There can be several reasons behind this choice, among which the most frequent are:

- Admittance that the business can not grow properly, without a significant injection of capital

- Need to access new markets, only possible through joining an international group

- Succession, generational issues

- Disagreement among shareholders

- The only alternative is the closure or liquidation of the company

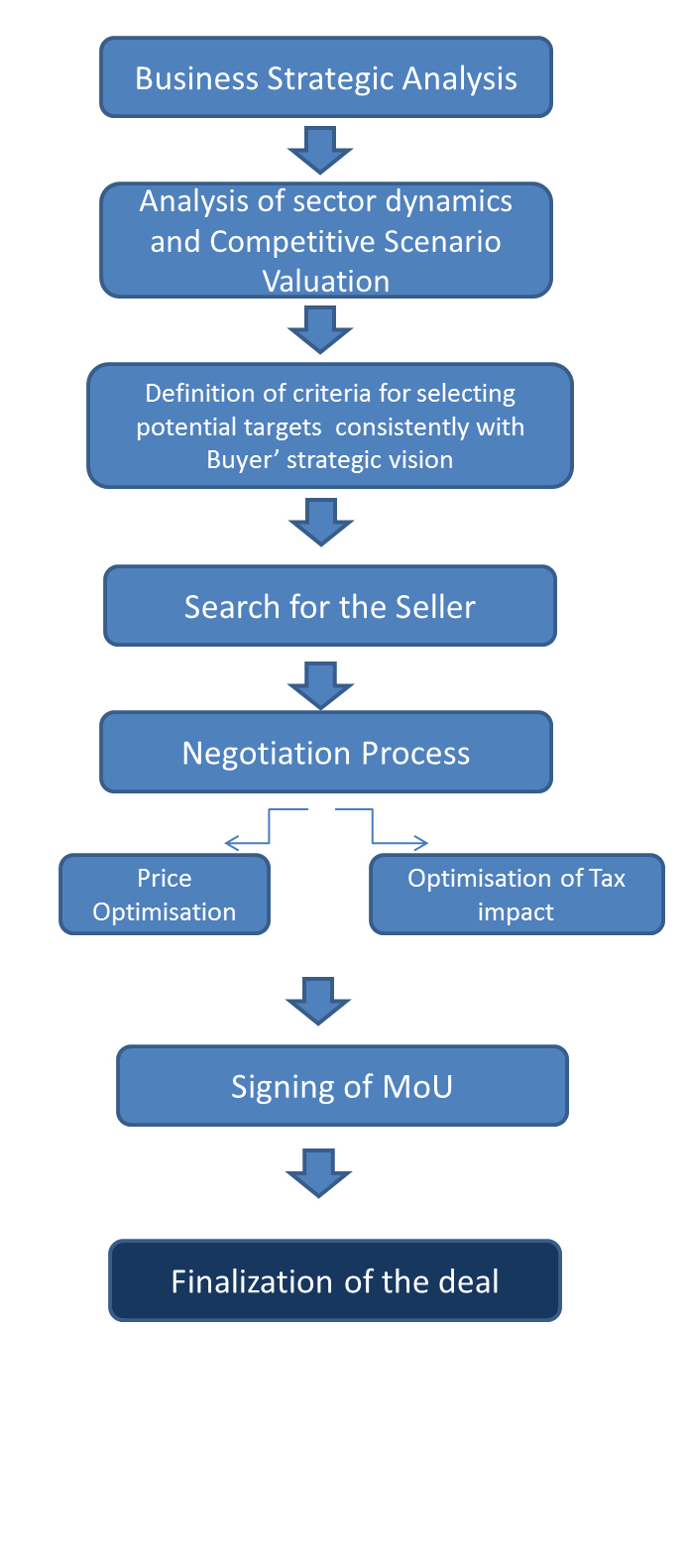

BUY A BUSINESS

The purchase process starts with the definition of the business of interest, usually in the same segment of the Buyer or segments complementary to that.

There can be several reasons behind this choice, among which the most frequent are:

- Availability of capital

- Need to grow the business

- Search for commercial synergies

- Search for synergies in production costs